40+ Layering In Money Laundering Would Be

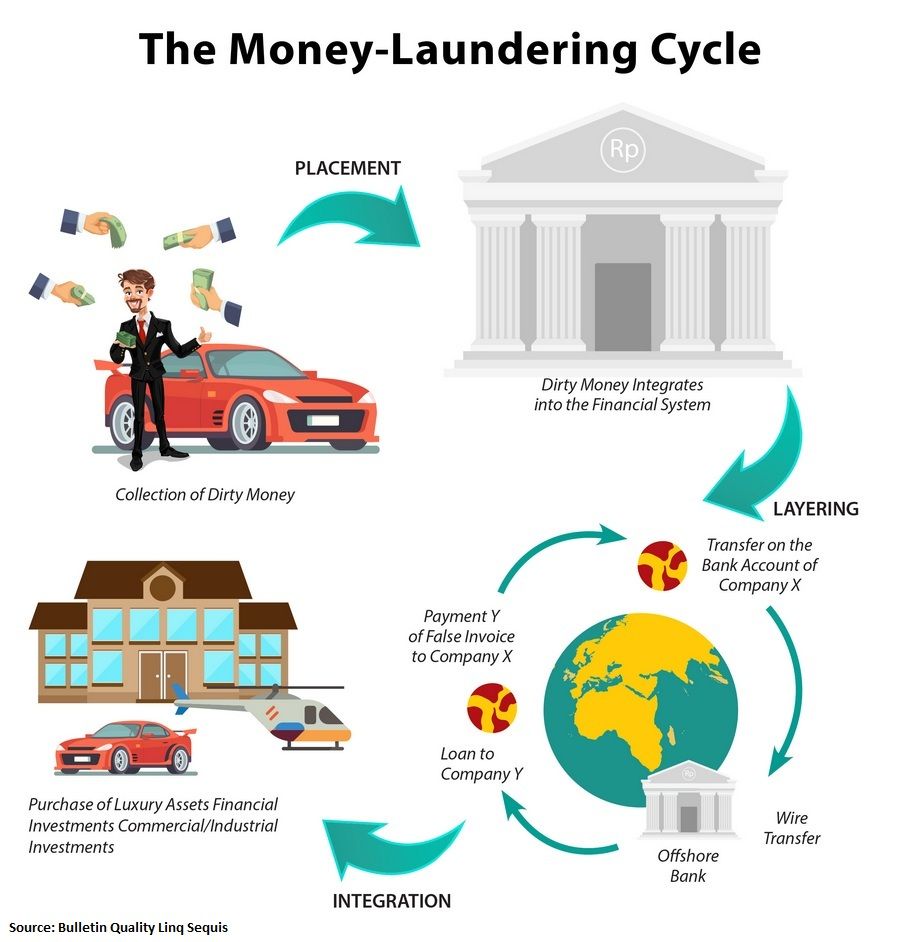

40+ Layering In Money Laundering Would Be. Generally, the more layers money passes through, the harder it becomes to connect the funds to criminal activity. Layering is the process by which multiple transactions are carried out in order to obscure the source of the money.

The criminal moves laundered money back into the financial system.

When the money reaches the integration stage its almost impossible to distinguish whether the money launders wealth is legal or illegal. During the layering stage, the goal is to disconnect the money from the illegal activity that generated it. What does layering mean in banking? Layering is often considered the most complex component of the money laundering process because it deliberately incorporates multiple financial instruments and transactions to confuse aml controls.

Comments

Post a Comment